What Does Pvm Accounting Mean?

What Does Pvm Accounting Mean?

Blog Article

The Definitive Guide to Pvm Accounting

Table of ContentsPvm Accounting Fundamentals ExplainedThe Buzz on Pvm AccountingTop Guidelines Of Pvm AccountingPvm Accounting Things To Know Before You Get ThisThe Best Guide To Pvm AccountingPvm Accounting - An Overview

Oversee and deal with the production and approval of all project-related payments to consumers to promote excellent interaction and prevent problems. construction bookkeeping. Guarantee that appropriate reports and documentation are submitted to and are updated with the internal revenue service. Guarantee that the accounting procedure adheres to the legislation. Apply called for building audit standards and procedures to the recording and coverage of construction task.Understand and keep common price codes in the accounting system. Communicate with different funding companies (i.e. Title Firm, Escrow Firm) regarding the pay application process and requirements needed for payment. Handle lien waiver dispensation and collection - https://pvmaccount1ng.wordpress.com/2024/05/22/mastering-construction-accounting-your-ultimate-guide/. Screen and solve financial institution issues including charge abnormalities and check differences. Help with carrying out and keeping internal financial controls and treatments.

The above declarations are meant to explain the general nature and level of work being performed by people designated to this classification. They are not to be construed as an extensive checklist of duties, duties, and abilities called for. Workers might be needed to carry out responsibilities outside of their normal duties once in a while, as needed.

About Pvm Accounting

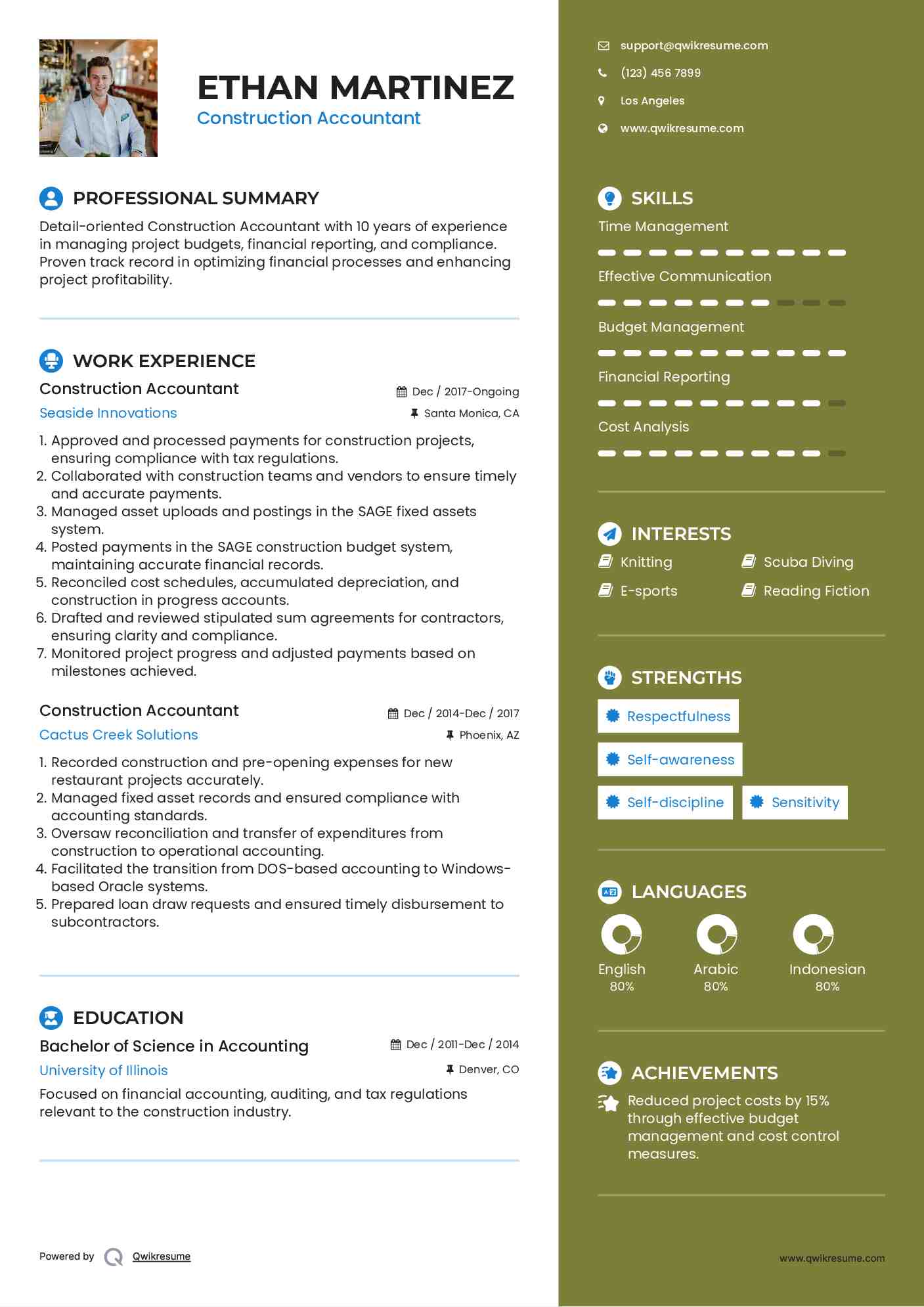

You will certainly aid support the Accel group to guarantee delivery of effective on schedule, on spending plan, jobs. Accel is looking for a Building and construction Accountant for the Chicago Workplace. The Building Accounting professional executes a range of accounting, insurance coverage compliance, and task management. Works both independently and within certain departments to preserve monetary records and make specific that all records are kept present.

Principal tasks include, however are not restricted to, dealing with all accounting features of the company in a prompt and accurate fashion and offering reports and schedules to the business's certified public accountant Company in the preparation of all financial statements. Makes certain that all audit procedures and features are taken care of accurately. Liable for all financial records, pay-roll, financial and day-to-day operation of the accountancy feature.

Prepares bi-weekly test equilibrium records. Works with Project Managers to prepare and post all monthly invoices. Procedures and concerns all accounts payable and subcontractor settlements. Creates month-to-month wrap-ups for Workers Compensation and General Liability insurance premiums. Creates monthly Work Price to Date records and working with PMs to fix up with Project Managers' allocate each project.

Our Pvm Accounting PDFs

Proficiency in Sage 300 Construction and Actual Estate (formerly Sage Timberline Workplace) and Procore building management software an and also. https://www.provenexpert.com/leonel-centeno/?mode=preview. Must also be skilled in other computer system software systems for the prep work of reports, spread sheets and various other bookkeeping evaluation that may be called for by administration. Clean-up bookkeeping. Must possess solid business skills and capability to focus on

They are the monetary custodians that make sure that construction jobs remain on budget, abide by tax laws, and keep monetary openness. Building and construction accountants are not just number crunchers; they are calculated companions look at this now in the construction process. Their main duty is to take care of the financial aspects of building tasks, ensuring that resources are designated successfully and financial dangers are minimized.

Some Known Questions About Pvm Accounting.

They work closely with project supervisors to develop and monitor budgets, track expenses, and projection economic requirements. By preserving a tight grip on task funds, accounting professionals assist stop overspending and financial troubles. Budgeting is a keystone of effective building tasks, and construction accountants contribute hereof. They develop detailed budget plans that encompass all task expenses, from materials and labor to permits and insurance.

Building and construction accounting professionals are fluent in these policies and make certain that the job complies with all tax obligation requirements. To succeed in the role of a building and construction accounting professional, individuals need a strong educational structure in accounting and financing.

Furthermore, accreditations such as Licensed Public Accountant (CPA) or Certified Construction Industry Financial Specialist (CCIFP) are very related to in the market. Building and construction jobs usually entail limited target dates, transforming laws, and unanticipated costs.

A Biased View of Pvm Accounting

Ans: Building accounting professionals develop and monitor budget plans, recognizing cost-saving chances and making certain that the job remains within budget plan. Ans: Yes, construction accounting professionals handle tax obligation conformity for building jobs.

Introduction to Building And Construction Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction firms need to make tough options among several economic options, like bidding on one task over one more, picking financing for materials or devices, or setting a job's profit margin. In addition to that, building is an infamously unstable sector with a high failing price, sluggish time to payment, and irregular capital.

Typical manufacturerConstruction service Process-based. Production entails duplicated processes with conveniently identifiable expenses. Project-based. Production requires different procedures, materials, and equipment with differing expenses. Repaired area. Production or production takes place in a single (or numerous) controlled areas. Decentralized. Each job occurs in a brand-new location with differing site problems and distinct obstacles.

The 9-Minute Rule for Pvm Accounting

Frequent use of various specialized contractors and suppliers affects efficiency and cash money circulation. Settlement shows up in full or with routine repayments for the full contract amount. Some part of payment might be held back till task completion even when the professional's work is finished.

While standard makers have the benefit of controlled settings and enhanced production procedures, building and construction business must continuously adapt to each brand-new job. Even rather repeatable projects call for adjustments due to website conditions and other variables.

Report this page